Why Cleaning Up Your Data Is Critical When You’re Looking to Sell Your Business

If you think selling your business is all about the price tag you are wrong. Savvy buyers dig deep into your operations. They judge your company by the data you hand over during due diligence. Unreliable or messy data can stall a sale, slash your valuation or even kill the deal. Cleaning up your data before sale is not a back‐office chore. It is a strategic move that proves your business is well run, de‑ribs risk and boosts buyer confidence.

This tactical guide shows you how to clean CRM records, financial systems, supply chain data and customer lists so you exit on your terms. Follow these steps and learn why data hygiene for business sale moves you from guess‑work to trusted partner.

The Hidden Risks of Dirty Data in an M&A Process

When buyers assess a target they expect transparency. Data errors trigger red flags:

Valuation drops when revenue numbers don’t match historical records

Negotiation stalls as buyers probe data inconsistencies

Deal fatigue from back‑and‑forth corrections

Earn‑out exposure if future performance metrics are unreliable

Post‑sale surprises when integration hits unclean systems

Impact on Business Valuation

A clean data environment commands premium multiples. Here is how data cleanup for business sale boosts value:

Accurate Revenue Recognition

Matching invoices with payments and contracts reduces revenue write‑backs

Buyers pay up to 0.5x more for reliable top‑line data

Cost Transparency

Cleaning purchase orders and supplier records uncovers true margins

Clean cost data supports aggressive bid multiples

Customer Retention Metrics

Verifiable churn and upsell rates give buyers confidence in future earnings

Clean Asset Lists

Up‑to‑date fixed asset registers ensure no surprises on balance sheet

Mid‑market companies that master data hygiene m&a see valuations rise by 10% to 20% compared to peers with messy records.

Due Diligence Demands: Prepare Data for Buyer Scrutiny

Due diligence teams dive into:

Financial statements (P&L, balance sheet, cash flow)

Customer data (CRM, support tickets, churn logs)

Contracts (sales, leases, vendor agreements)

HR and payroll

IT systems and backups

If you scramble to find correct records you trigger doubts. Buyers build issues lists to negotiate price reductions or walk away. Follow these steps to prepare data for due diligence:

Consolidate systems: Export data from CRM, ERP and niche tools into a central data warehouse.

Reconcile transactions: Match bank statements against accounting entries and invoices.

Clean contact lists: Remove duplicates, merge accounts and verify key contacts.

Standardise formats: Ensure dates, currencies and region codes align across tables.

Document data lineage: Track how data moves from source to report so buyers trust your figures.

These tactics reduce due diligence queries by up to 30% and speed up deal timelines.

Operational Integration: Smoother Post‑Sale Transitions

Buyers value businesses that integrate without friction. Clean data simplifies:

ERP migrations: Fewer mapping errors between legacy and new systems

CRM merges: Faster onboarding of customer records into buyer platforms

BI consolidation: Easier mix of analytics and reporting across combined entity

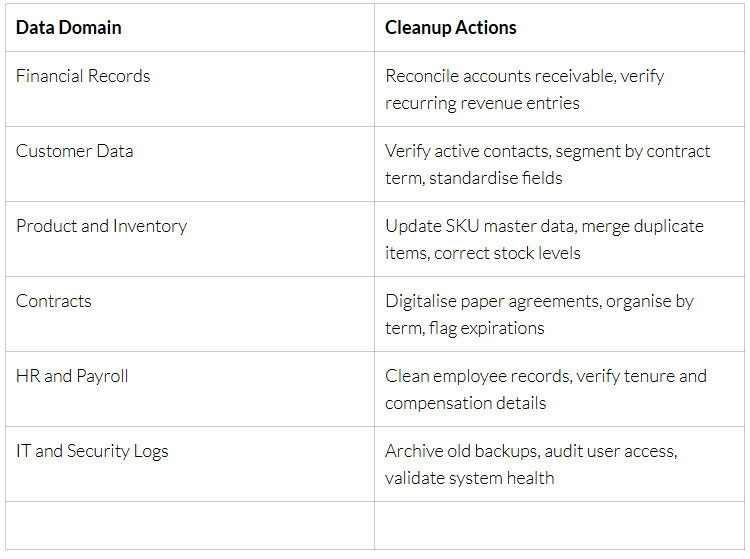

Key Areas to Tackle in Your Data Cleanup for Sale

Tackling each domain ensures no surprises slip through the M&A filter.

Tactical Steps to Clean Data Before Business Sale

Follow this 6‑step process to deliver clean, buyer‑ready data:

Audit and Prioritise

Run discovery reports on data completeness, duplication rates and error counts

Prioritise areas with highest impact on valuation and risk

Define Standards and Governance

Agree on data definitions, naming conventions and field requirements

Assign data stewards with clear responsibilities

Document governance rules in a data playbook

Deduplicate and Merge

Use tools like RingLead, D&B Optimizer or native functions in Salesforce/HubSpot

Validate merges with sample checks before bulk operations

Standardise and Format

Apply consistent date, currency and region formats

Clean text fields: fix case sensitivity, remove special characters

Archive or delete unused fields to simplify schemas

Validate and Enrich

Verify emails and phone numbers with BriteVerify or NeverBounce

Append missing company details via Clearbit or ZoomInfo

Load enriched data back into source systems and re‑export for buyer

Automate Ongoing Hygiene

Schedule nightly or weekly data quality jobs

Set up alerts for missing mandatory fields or spikes in duplicates

Train staff on new processes and tools to prevent new issues

Keyword: data cleanup for business sale. This process readies your systems for buyer inspection and accelerates deal closing.

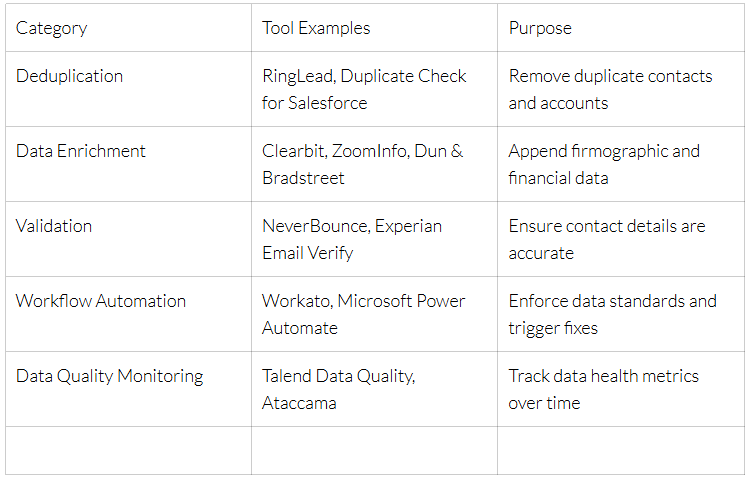

Tools and Platforms for Data Hygiene in M&A

Selecting the right blend of tools maximises data quality and showcases your professional approach to buyers.

Conclusion: Your Exit Depends on Clean Data

Selling a business is a marathon not a sprint. Dirty data adds miles to the finish line and opens doors for buyer demands to erode your deal value. Mid‑market business leaders cannot afford sloppy records at exit. Data cleanup for business sale is your best defence and offence:

Defence: Shield against valuation haircut and due diligence delays

Offence: Demonstrate operational excellence, justify higher multiples

Don’t leave your exit to chance. Start cleaning your data today and position your business as an attractive, low‑risk acquisition. Buyers pay more and close faster when they see reliable, well‑governed data.

Pentify Insights partners with mid‑market companies across Australia to prepare data for sale. Reach out at www.pentifyinsights.com for a free data readiness assessment and make your business sale a success.